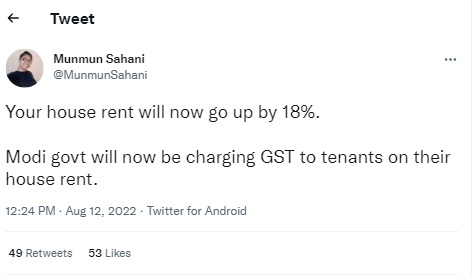

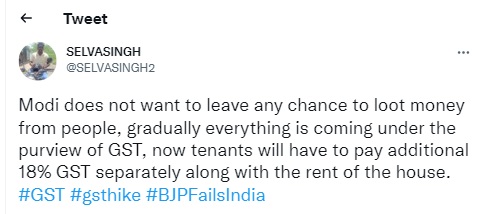

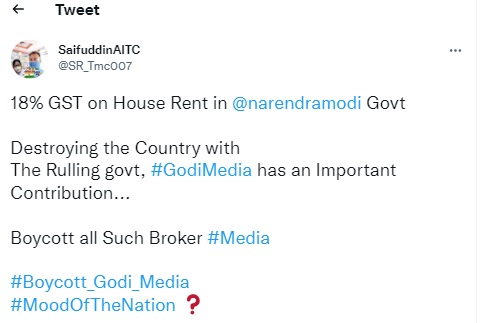

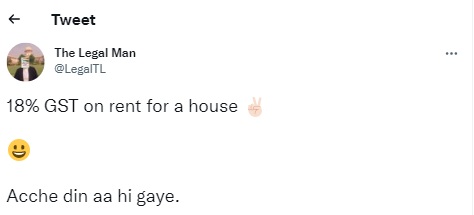

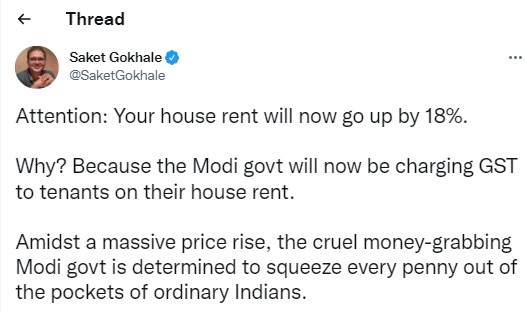

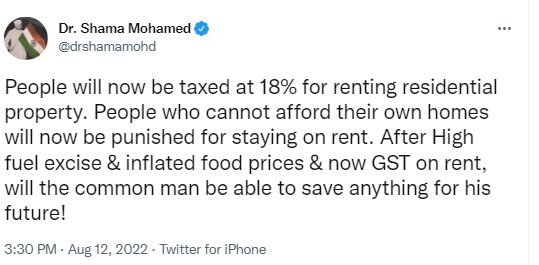

The government has imposed a GST of 18% on house rent from all tenants, claimed several Twitter users, triggering outrage among many on social media. One such tweet said, “Modi does not want to leave any chance to loot money from people, gradually everything is coming under the purview of GST, now tenants will have to pay additional 18% GST separately along with the rent of the house.” Another user remarked, “18% GST on rent for a house…Acche din aa hi gaye.”

Archived versions of the posts can be found here, here, here and here.

A fact-check by Newschecker found the claims to be misleading as the new law implies renting of residential units are taxable only when used for business purposes.

Fact Check/Verification

Newschecker did a keyword search for the terms “GST 18% rent”, “GST 18% house rent”, which threw up multiple news reports that sought to dispel the confusion on the matter.

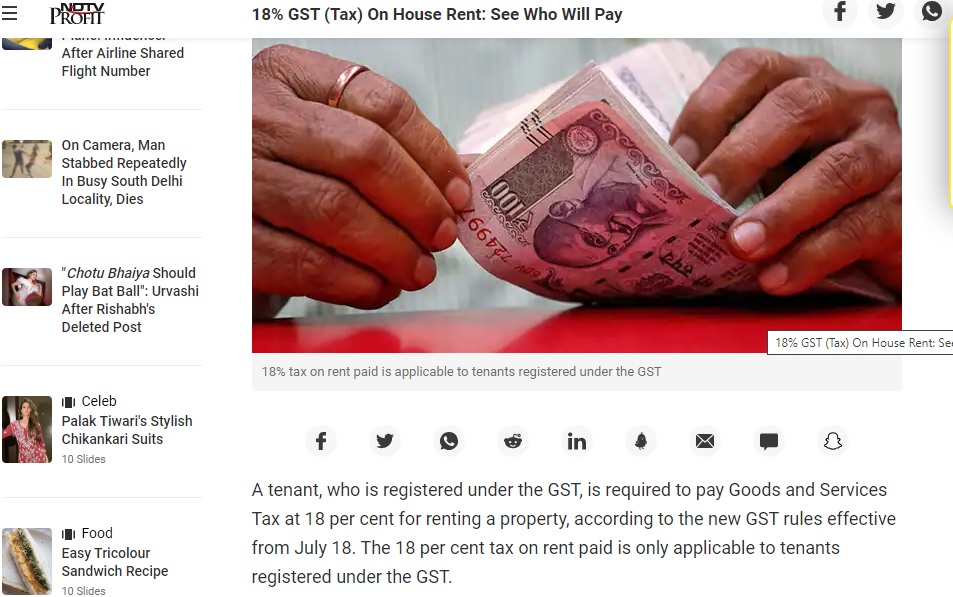

According to an NDTV report, “A tenant, who is registered under the GST, is required to pay Goods and Services Tax at 18 per cent for renting a residential property, according to the new GST rules effective from July 18. The 18 per cent tax on rent paid is only applicable to tenants registered under the GST. Earlier, only commercial properties like offices or retail spaces given on rent or lease attracted GST. There was no GST on rent or lease of residential properties by corporate houses or individuals”.

A report in Mint read, “According to tax experts, until 17th July 2022, GST was applicable on the rent of a commercial property but from 18th July 2022, GST shall be charged if such residence is rented or leased by a GST-registered person. As recommended at the 47th GST Council meeting, the tenant should pay 18 per cent GST on a reverse charge basis (RCM). However, they can claim this value as a deduction while they pay tax on sales in GST returns.”

All the news reports clarified that if any common salaried person has taken a residential house or flat on rent or lease, they do not have to pay GST. They reiterated that a GST-registered person who carries out a business or profession must incur 18% GST on such a rent paid to the owner.

“If you are a salaried employee, and have taken a flat on rent, the recently introduced 18% goods and service tax under the reserve charge mechanism will not apply to you,” stated a Times of India article.

Newschecker then found a press release by the Ministry of Finance on the recommendations of the 47th GST Council Meeting, which stated that the exemption on renting of residential dwelling to business entities (registered persons) was withdrawn.

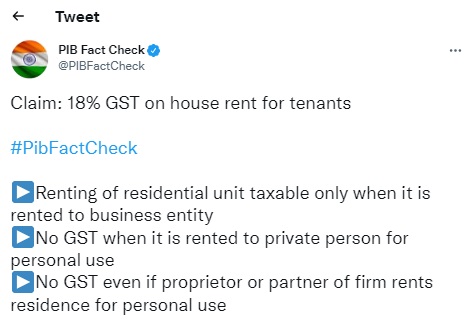

Newschecker also found a tweet by PIB debunking the claim. “Renting of residential unit taxable only when it is rented to business entity; no GST when it is rented to private person for personal use; no GST even if proprietor or partner of firm rents residence for personal use,” the tweet read.

Mint carried another report on August 12, referring to PIB’s tweet and clarifying that the government said renting of residential units are taxable only when it is rented to a business entity .

We also got in touch with Pune-based CA Pritam Mahure (founder, CA Pritam Mahure and Associates), who said, “GST is applicable on renting of residential dwelling when it is given on rent to a GST-registered entity and in such cases, GST is to be paid by that company directly to the government. GST is not applicable on renting of residential dwelling by an individual to another individual. To put it simply, only when a residential dwelling is given on rent to a GST-registered entity then GST is payable, but not by the property owner, but by such a GST-registered entity.”

Newschecker further reached out to Archit Gupta, Founder and CEO, Clear, a tax-filing assistance company, who said, “Until 17th July 2022, GST was not charged on renting or leasing residential properties. However, from 18th July 2022 onwards, GST shall be collected if such residence is rented or leased by a GST-registered person. This means GST shall have to be paid on rent (on residential dwelling) if you are already registered under GST and you have taken a place on rent or lease (such a person would already be doing a business or a profession and must be covered under the GST act for registration). Such tenants may have to in fact discharge tax under RCM basis. Another issue around this could be the availability of ITC on such GST paid, which may have to be separately clarified by the government.”

RCM refers to reverse charge mechanism, where the recipient of the goods or services is liable to pay GST, instead of the supplier. ITC refers to input tax credit, which means at the time of paying tax on output, you can reduce the tax you have already paid on inputs and pay the balance amount.

Conclusion

Viral claim that an 18% GST will be imposed on house rent was found to be partly false as the new rule is applicable to those tenants that are registered under the GST and are using the residential property for business purposes. There is no GST when the house is rented to a private individual for personal use.

Result: Partly false

Our sources

PIB, Recommendations of 47th GST Council Meeting, June 29, 2022

NDTV, 18% GST (Tax) On House Rent: See Who Will Pay, August 12, 2022

Mint, New GST rule on house rent: Do you have to pay 18% tax?, August 5, 2022

Times of India, Explained: When is 18% GST applicable for renting of residential properties, July 21, 2022

Telephonic conversation with Pritam Mahure (founder, CA Pritam Mahure and Associates)

E-mail with Archit Gupta, Founder and CEO, Clear

If you would like us to fact-check a claim, give feedback, or lodge a complaint, WhatsApp us at 9999499044 or email us at checkthis@newschecker.in. You can also visit the Contact Us page and fill out the form.